I’ll never forget the panic I felt during our first investor meeting. We’d been growing fast—demos were converting, customers were happy, and our bank account looked healthy. But when the investor asked about our MRR growth and churn rates, I fumbled through a messy spreadsheet that painted zero clear picture of our actual revenue trajectory.

That embarrassing moment taught me something crucial: tracking sales revenue isn’t just about knowing how much money you made last month. It’s about understanding the story your numbers tell—and being able to tell that story confidently to investors, team members, and yourself.

If you’re a SaaS founder or running a small sales team, you’ve probably felt this frustration. You know your business is growing, but proving it with clean, reliable data? That’s where things get messy. Let’s fix that.

So, what exactly is tracking and reporting business sales revenue?

![]()

At its core, tracking business sales revenue means systematically recording, categorizing, and analyzing every dollar that flows into your business from sales activities. But here’s where it gets interesting for SaaS companies—it’s not just about when money hits your bank account. You need to track recurring revenue patterns, understand customer lifetime value, and recognize revenue according to when you actually deliver the service.

Reporting takes that tracked data and transforms it into actionable insights. Think of tracking as collecting the ingredients, and reporting as cooking the meal that actually feeds your decision-making process.

The magic happens when your tracking and reporting systems work together to give you real-time visibility into not just what happened, but what’s likely to happen next.

How does sales revenue tracking actually work in practice?

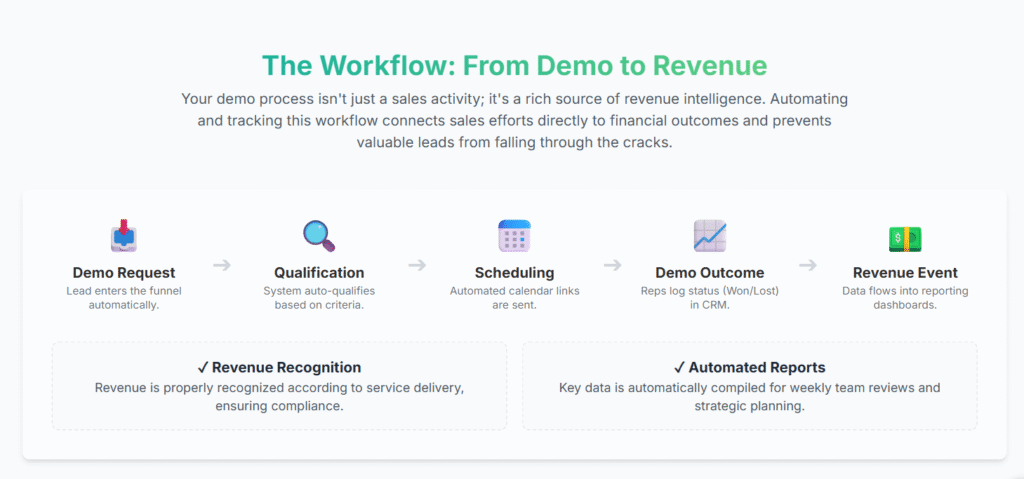

For most SaaS companies, effective revenue tracking operates on three levels. First, you’re capturing lead and demo data—every conversation, every follow-up, every outcome. Tools like integrated CRM systems can automate this process, ensuring nothing slips through the cracks.

Second, you’re monitoring subscription metrics. This means tracking Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), and customer churn in real-time. According to industry data, companies that closely monitor MRR can identify growth opportunities faster and reduce churn more effectively.

Third, you’re connecting the dots between your sales activities and revenue outcomes. When a demo converts to a paid customer, that connection should be automatically logged and attributed to the right team member and campaign.

Here’s what this looks like day-to-day:

- Demo requests automatically flow into your tracking system

- Sales team updates deal status and demo outcomes

- Revenue recognition happens according to service delivery

- Reports generate automatically for weekly team reviews

What are the main benefits of proper revenue tracking?

The biggest advantage? You stop making decisions based on gut feelings and start making them based on data. I learned this the hard way when we nearly hired three new sales reps based on what felt like explosive growth—until proper tracking revealed that our customer acquisition cost was actually higher than our lifetime value.

Proper tracking also improves your team’s accountability and coordination. When everyone can see demo outcomes, follow-up status, and conversion rates in one dashboard, nobody’s wondering who’s supposed to call which prospect back.

From a compliance standpoint, accurate revenue recognition protects you during audits and investor due diligence. SaaS companies must follow standards like ASC 606, and manual tracking makes this nearly impossible to get right consistently.

When should you prioritize setting up revenue tracking?

The honest answer? Yesterday. But if we’re being practical, you should have systems in place before you hit $10K in monthly recurring revenue or when you have more than 50 active customers. At that point, spreadsheets become dangerous.

I also recommend prioritizing this if you’re planning to raise funding within the next 12 months. Investors will ask specific questions about unit economics, and you want to answer confidently with clean data.

However, don’t wait for the perfect system. Start with something simple that captures the basics, then iterate as you grow.

![]()

What mistakes should you avoid with revenue tracking?

The biggest mistake I see founders make is trying to build the perfect system from day one. You’ll spend months configuring complex workflows instead of actually selling. Start simple, then add complexity as you need it.

Another common pitfall is tracking vanity metrics instead of actionable ones. Total revenue sounds impressive, but MRR growth rate tells a much more important story about your business health.

Finally, avoid disconnected systems. If your demo scheduling tool doesn’t talk to your CRM, and your CRM doesn’t connect to your billing system, you’ll waste countless hours manually connecting the dots.

Why This Matters More Than Ever

Here’s the reality: in today’s competitive landscape, founders who can’t articulate their unit economics don’t get second meetings with investors. Teams that lose track of leads don’t hit growth targets. Companies that guess at churn rates make hiring and spending decisions that can sink the business.

But there’s a deeper reason this matters. Proper revenue tracking transforms how you think about your business. Instead of celebrating good months and worrying about bad ones, you start recognizing patterns. You notice that enterprise demos convert at 40% while SMB demos convert at 15%. You realize that customers from certain industries churn faster. You discover that follow-up calls within 24 hours of a demo increase close rates by 60%.

This isn’t just accounting—it’s competitive intelligence about your own business.

The Foundation: Key Metrics That Actually Matter

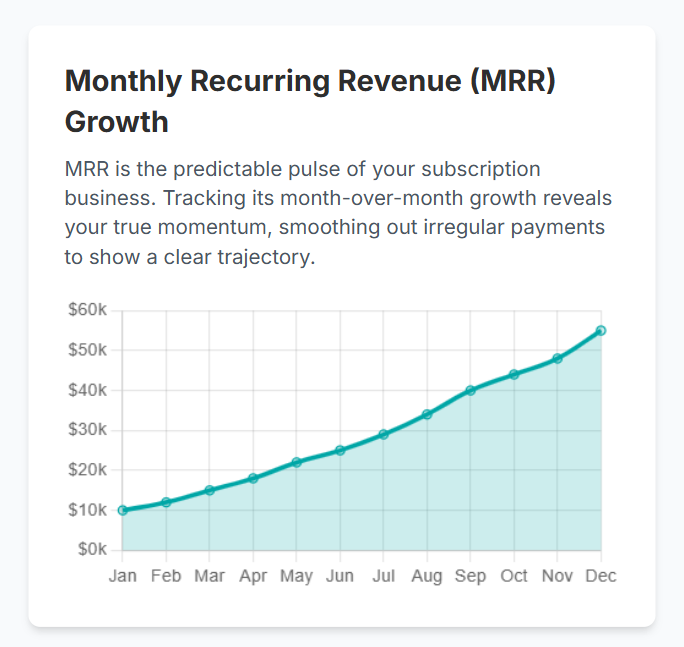

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

Let’s start with the metrics that matter most for SaaS companies. MRR represents your predictable monthly subscription income, normalized to show true monthly value. If a customer pays $1,200 annually, that’s $100 in MRR.

ARR simply annualizes this figure, giving you a longer-term view of revenue trends. Both metrics help you understand growth velocity and the effectiveness of your sales and marketing efforts.

Here’s why these matter: MRR and ARR smooth out the noise of irregular payment schedules and give you a clear picture of business momentum. They’re also the metrics investors care about most when evaluating SaaS companies.

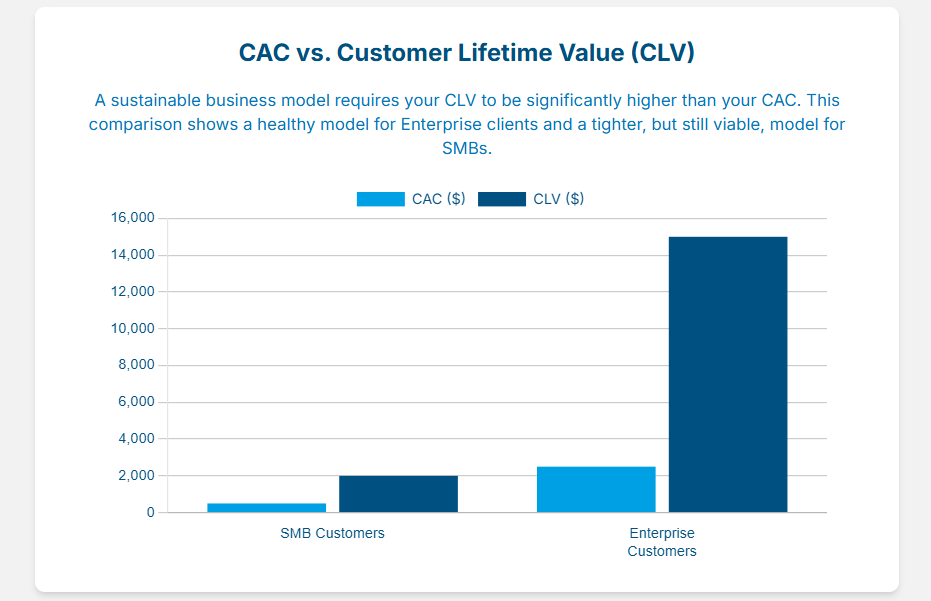

Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV)

CAC tells you how much you spend to acquire each new customer, including sales team costs, marketing spend, and demo-related expenses. CLV predicts the total revenue you’ll generate from a customer relationship.

The relationship between these metrics determines whether your business model works. If you spend $500 to acquire a customer worth $2,000 over their lifetime, you have a sustainable business. If those numbers are reversed, you have a problem.

Smart founders track CAC by channel and customer segment. You might discover that customers from product-led growth convert cheaper but have lower lifetime value, while enterprise customers cost more to acquire but stick around longer.

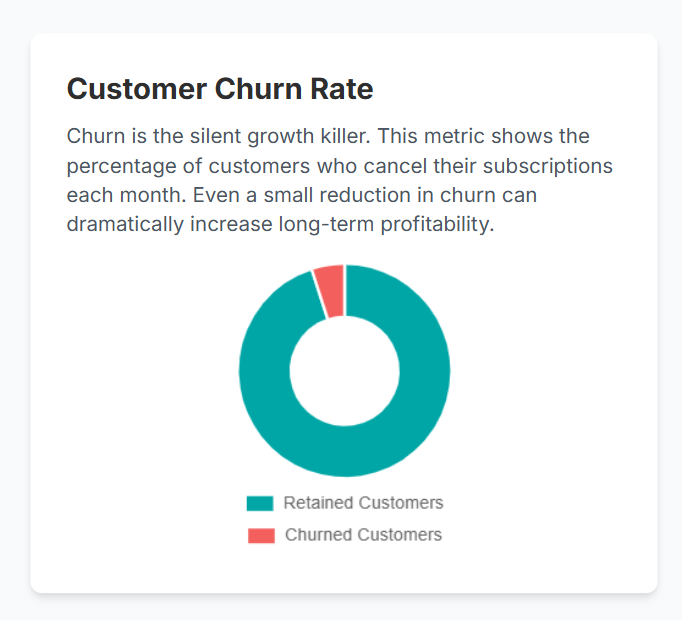

Customer and Revenue Churn Rates

Churn rate measures how many customers (or how much revenue) you lose each month. Customer churn counts the number of customers who cancel, while revenue churn accounts for the dollar impact of those cancellations.

Industry data shows that reducing churn by just 1% can increase profits by 25% to 95%. That’s why tracking churn isn’t just nice-to-have—it’s essential for sustainable growth.

Pay attention to cohort analysis here. Are customers who joined six months ago churning faster than those who joined last month? That might indicate onboarding problems or product-market fit issues with specific customer segments.

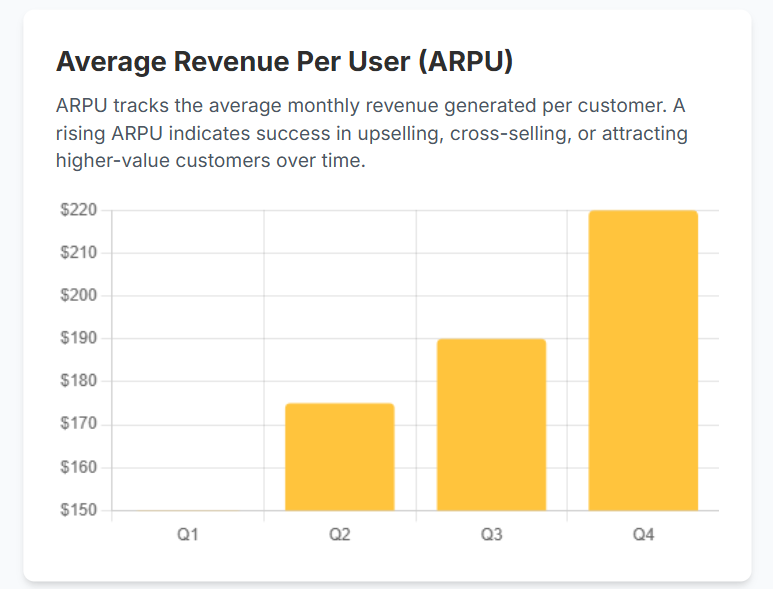

Average Revenue Per User (ARPU)

ARPU helps you understand customer value and identify upselling opportunities. It’s particularly useful for segmenting customers and tailoring sales approaches.

If your ARPU is increasing over time, it suggests successful upselling or attracting higher-value customers. If it’s decreasing, you might be attracting smaller customers or experiencing downgrade pressure.

Setting Up Your Tracking Infrastructure

![]()

Choosing the Right Tools

The tool landscape can be overwhelming, but you don’t need enterprise-grade solutions from day one. Start with tools that integrate well and can grow with you.

For CRM and demo management, platforms like HubSpot offer good free tiers, but specialized tools like LevelUp Demo can streamline your demo workflow more effectively. The key is choosing tools that talk to each other.

For payment and subscription management, Stripe handles most SaaS billing needs and provides solid reporting APIs. More complex revenue recognition requirements might call for specialized platforms like Younium.

The critical factor is integration. Your demo scheduling should feed your CRM, which should connect to your billing system, which should inform your reporting dashboard. Manual data entry between systems is where errors creep in and opportunities get lost.

Revenue Recognition Methods for SaaS

This is where things get technical, but stick with me—it’s important. SaaS revenue recognition isn’t as simple as recording money when it hits your bank account. You need to recognize revenue as you deliver the service.

Common methods include:

- Prorated recognition: Revenue spread evenly over the service period

- Milestone-based: Revenue recognized when specific deliverables are met

- Usage-based: Revenue tied to actual platform usage

- Proportional performance: Revenue recognized based on service delivery completion

Most subscription SaaS companies use prorated recognition, but your specific situation might call for different approaches. The key is consistency and compliance with accounting standards like ASC 606.

Automated subscription management tools can handle these calculations for you, reducing errors and ensuring compliance. This becomes crucial as you scale and face investor due diligence or financial audits.

Streamlining Demo Workflows for Better Tracking

The Demo-to-Revenue Connection

Here’s something most founders miss: your demo process is a goldmine of revenue intelligence. Every demo request tells you something about demand. Every demo outcome reveals something about your sales process. Every follow-up interaction provides data about customer behavior.

But only if you’re tracking it properly.

The most successful small sales teams treat demo management as part of their revenue tracking system, not a separate process. When someone requests a demo, that’s the beginning of a revenue story that might unfold over weeks or months.

Automating Demo Scheduling and Follow-up

Manual demo scheduling is where leads go to die. I’ve seen too many promising prospects fall through the cracks because someone forgot to send a calendar link or follow up after a demo.

Modern demo management platforms automate this entire workflow. A prospect fills out your demo form, gets automatically qualified based on your criteria, receives a calendar link, and gets added to your CRM—all without manual intervention.

More importantly, these systems track outcomes. When your sales rep marks a demo as “won,” “lost,” or “follow-up needed,” that data flows into your revenue reporting automatically.

Creating Accountability in Small Teams

Small sales teams need visibility into who’s doing what. A centralized dashboard showing demo requests, scheduled demos, completed demos, and follow-up status keeps everyone accountable.

The best systems let you filter by team member, date range, and outcome. You can quickly see that Sarah has five follow-ups pending, or that enterprise demos scheduled on Tuesdays convert 20% better than those scheduled on Fridays.

This visibility transforms team meetings from status updates to strategic discussions about what the data reveals and how to act on it.

Building Your Reporting Framework

Real-Time Dashboards vs. Periodic Reports

You need both, but for different purposes. Real-time dashboards help with daily operations—who needs to follow up with prospects, which deals are stuck, how this month’s MRR is trending.

Periodic reports serve strategic planning. Monthly reports should show MRR growth, churn analysis, and CAC trends. Quarterly reports might dive deeper into cohort analysis and customer segmentation insights.

The key is making sure both types of reporting draw from the same underlying data. Nothing destroys confidence in your numbers like having different reports show conflicting figures.

Key Performance Indicators (KPIs) to Monitor

Focus on metrics that drive action, not just measurement. Here are the KPIs that matter most for SaaS revenue tracking:

Growth Metrics:

- MRR growth rate (month-over-month and year-over-year)

- New customer acquisition rate

- Expansion revenue from existing customers

Efficiency Metrics:

- Customer acquisition cost by channel

- Demo-to-close conversion rate

- Average sales cycle length

Health Metrics:

- Monthly churn rate (customers and revenue)

- Net revenue retention

- Customer health scores

Each metric should have a clear owner and defined action thresholds. If demo conversion drops below 15%, what’s your response plan? If churn exceeds 8%, who investigates why?

Forecasting and Predictive Analytics

Once you have clean historical data, you can start predicting future performance. Simple linear projections work for stable businesses, but SaaS companies benefit from more sophisticated forecasting that accounts for seasonality, cohort behavior, and sales pipeline velocity.

Look for patterns in your data. Do customers who take longer to convert have higher lifetime value? Do certain demo outcomes predict faster expansion revenue? These insights help you allocate resources more effectively.

The goal isn’t perfect predictions—it’s better decision-making based on data trends rather than intuition.

Common Pitfalls and How to Avoid Them

The Spreadsheet Trap

I get it—spreadsheets are familiar and flexible. But they’re also error-prone and don’t scale. The moment you have multiple people updating the same spreadsheet, you’re asking for trouble.

More importantly, spreadsheets don’t integrate with your other systems. Every piece of data requires manual entry, which means delays, mistakes, and missed opportunities.

If you’re still using spreadsheets for revenue tracking, set a deadline to migrate to proper tools. Your future self will thank you.

Vanity Metrics vs. Actionable Metrics

Total registered users sounds impressive, but it doesn’t tell you much about business health. Monthly active users is better. Paying customers is even better. MRR growth rate is what actually matters.

Focus on metrics that connect to business outcomes. If improving a metric would directly impact revenue, track it. If it just makes you feel good, consider whether it deserves dashboard real estate.

Over-Engineering Your Initial Setup

The perfect system is the enemy of the good system. Start with basic tracking that covers the essentials:

- Lead source and demo requests

- Demo outcomes and follow-up status

- Customer acquisition and MRR

- Basic churn tracking

You can add sophistication later. The important thing is starting with clean, consistent data capture.

Ignoring Data Quality

Garbage in, garbage out. If your sales team isn’t consistently updating demo outcomes, your conversion metrics are worthless. If customer data isn’t properly segmented, your cohort analysis misleads more than it helps.

Establish clear data entry standards and make updating records part of your team’s workflow. Regular data audits help catch inconsistencies before they compound.

Advanced Revenue Intelligence

Customer Segmentation and Cohort Analysis

Not all customers are created equal. Enterprise customers might have longer sales cycles but higher lifetime value. SMB customers might convert faster but churn more frequently.

Cohort analysis reveals how customer behavior changes over time. Are customers who joined in January more likely to upgrade than those who joined in July? Do customers from certain industries have predictable expansion patterns?

This intelligence helps you tailor sales approaches, set realistic expectations, and allocate resources more effectively.

Connecting Sales Activities to Revenue Outcomes

The most valuable insight comes from connecting sales activities to revenue results. Which demo formats convert best? How does follow-up timing affect close rates? What customer characteristics predict higher lifetime value?

This requires tracking the entire customer journey from first touchpoint to renewal. It’s complex, but the insights transform how you approach sales and marketing.

Predictive Customer Health Scoring

Advanced tracking systems can predict which customers are likely to churn, upgrade, or become advocates. These predictions help you intervene proactively rather than reactively.

Customer health scores might factor in product usage, support ticket frequency, payment history, and engagement with your team. The goal is identifying at-risk customers before they churn and high-potential customers before they’re approached by competitors.

Frequently Asked Questions

What’s the difference between tracking revenue and recognizing revenue? Tracking revenue means recording when money comes in, while revenue recognition follows accounting standards for when you’ve actually earned that revenue. For SaaS companies, you typically recognize revenue over the service period, not when payment is received.

How often should I review my revenue reports? Daily operational metrics (like demo pipeline) should be monitored continuously. Weekly reviews work for MRR and conversion trends. Monthly deep dives into churn, CAC, and customer segmentation provide strategic insights without overwhelming your team.

What’s the most important metric for early-stage SaaS companies? MRR growth rate tells the most complete story about business momentum. It captures new customer acquisition, expansion revenue, and the impact of churn in one number that’s easy to understand and benchmark.

Should I track gross revenue or net revenue? Both, but net revenue (after refunds, chargebacks, and discounts) gives you a more accurate picture of business health. Gross revenue can hide problems that net revenue reveals.

How do I handle revenue from annual vs. monthly subscriptions? Normalize everything to monthly figures for comparison purposes. An annual $1,200 subscription equals $100 MRR. This lets you compare customer value regardless of payment frequency.

What’s the best way to track demo outcomes? Use simple, consistent categories like Won, Lost, In Progress, and Follow-up Needed. More important than the specific categories is making sure your team uses them consistently and updates them promptly.

How do I calculate customer lifetime value accurately? Start simple: average monthly revenue per customer divided by monthly churn rate. As you gather more data, you can add complexity by segmenting customers and factoring in expansion revenue patterns.

When should I invest in advanced revenue tracking tools? When manual processes consume more than a few hours per week, when you’re making strategic decisions based on incomplete data, or when you’re preparing for fundraising or acquisition discussions.

How do I ensure data quality in my revenue tracking? Establish clear data entry standards, make record updates part of your team’s daily workflow, and conduct regular audits to catch inconsistencies. Automated systems reduce human error significantly.

What should I do if my revenue tracking reveals concerning trends? Don’t panic, but don’t ignore them either. Investigate the underlying causes, segment the data to understand which customer types or channels are affected, and develop specific action plans to address the issues.

Taking Action: Your Next Steps

Revenue tracking might seem overwhelming, but remember—you don’t need to solve everything at once. Start with the basics: clean data capture, consistent reporting, and automated workflows that save your team time.

The goal isn’t perfect data—it’s better decision-making. Every improvement in your tracking and reporting capabilities compounds over time, giving you clearer insights into what’s working and what needs attention.

For SaaS founders and small sales teams, the combination of proper revenue tracking and streamlined demo workflows creates a powerful competitive advantage. You’ll close more deals, lose fewer leads, and make strategic decisions based on data instead of guesswork.

If you’re ready to streamline your demo process and connect it to your revenue tracking, LevelUp Demo offers a lightweight solution designed specifically for growing SaaS companies. It’s the kind of tool I wish I’d had during that embarrassing investor meeting—one that turns messy demo workflows into clean, actionable revenue intelligence.

The best time to start tracking your revenue properly was when you got your first customer. The second-best time is right now.